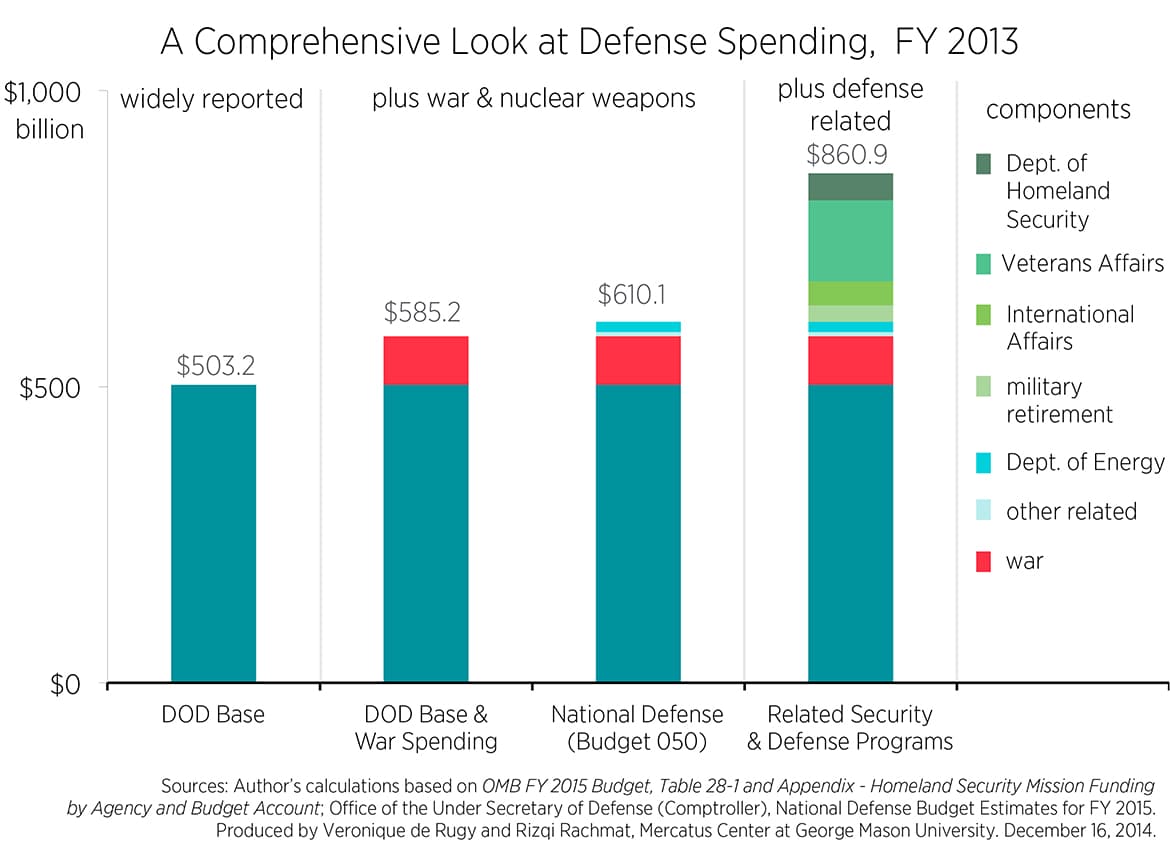

In a recent publication of the Mercatus Center at George Mason University, “Defense Spending Extends Beyond the Pentagon’s Budget,” Veronique de Rugy presents a valuable compilation of data for fiscal year 2013, showing how much of the government’s national security spending appears not in the base budget of the Department of Defense, but elsewhere in the government’s budget. This point is important because in debates about Pentagon funding, those who favor giving the Pentagon more money generally rest their arguments on references to the amount appropriated for the Pentagon’s base budget alone, ignoring the substantial amounts that appear under other rubrics in the government’s overall budget.

De Rugy shows that for fiscal year 2013, the Pentagon’s base budget alone amounted to only 68 percent of the grand total for all national security spending. In her accounting, the grand total also includes amounts spent primarily by the departments of Defense (for war, budgeted separately from the base budget), Energy (for nuclear weapons programs), State, Homeland Security, Veterans Affairs, and the Treasury (for a portion of the military retirement budget). By excluding these huge amounts of funding ($358 billion), the drain on the nation’s financial resources is greatly understated and hence the debate badly distorted.

De Rugy notes in passing that her grand total “does not include the associated interest costs on the debt, which would add to the total amount.” Quite so. In similar accounting exercises that I carried out from time to time over the past decade or so, I found that adding an amount attributable to the current financing costs of past debt-financed national security spending increased the grand total of national security spending by 30 percent in fiscal year 2002, by 28 percent in fiscal year 2006, and by 14 percent in fiscal year 2009. The reduced percentage addition in 2009, compared to fiscal years 2002 and 2006, reflects not only the increase in the base of the ratio, but also the artificially reduced interest rates that prevailed in fiscal year 2009 ─ and, we should note, in every year since then ─ owing to the Federal Reserve’s actions to keep interest rates, especially those on the government’s debt, far below free-market levels.

Nevertheless, if we were to add to de Rugy’s grand total of national security spending even the 14 percent addition that I previously computed as appropriate in fiscal year 2009, we would increase that grand total by $120.5 billion, which is hardly a negligible sum. A more defensible addition, which would be an estimate of the true free-market opportunity cost in fiscal year 2013 of the nation’s past debt-financed national security spending (debt still outstanding), would probably be in the neighborhood of twice as much, that is, roughly $241 billion.

Some analysts have argued against the inclusion of an amount for the current financing cost of past debt-financed national security spending, but such arguments do not hold water. If you borrow to buy a house, the annual interest expense on your mortgage loan is certainly part, usually the lion’s share, of the total costs of your occupancy of that house throughout any subsequent year and of your having acquired it in the first place. Likewise, if the government borrows to finance national security outlays, the subsequent interest costs associated with that debt certainly ought to be included in the total expense of the nation’s national security programs in any given year. To leave out such interest expense is to assume implicitly that any amount of spending for national security currently financed by borrowing (that has not been repaid since) entails no subsequent annual cost, which is an economically indefensible assumption.

Reprinted with author’s permission from the Independent Institute.