Legal marijuana in Colorado has been a boon for freedom, allowing people to make, transfer, and consume marijuana products free from the threat of arrest by state or local police. At the same time, there is an unfortunate side-effect of the liberalization of marijuana laws in the state — the government scooping up great amounts of money via marijuana “sin taxes.”

The high marijuana taxes punish people who purchase marijuana by depriving them of money to save, to give away, or to spend on other goods or services. The sin taxes also are a means of controlling people’s behavior. Facing high taxes, some people will forgo or reduce their purchases of products containing the plant.

Proponents of the sin taxes claim the taxes are justified because using marijuana is a sin that should be discouraged. But, even if it is granted that there is some truth in that claim, a much greater sin is the use of government force via taxation to control people’s nonviolent activities.

There is plenty of marijuana sin tax to roll back in Colorado. Ethan Wolff-Mann calculates in Money magazine that sales and excise taxes increase the price of marijuana by 27.9% in the state.

The gouging of marijuana purchasers is reason enough to oppose the high taxes. In addition, there is the concern that all this tax revenue feeds the government machine that tramples on individual rights, including through enforcing laws against other drugs that are still illegal and even through clamping down on marijuana activities that take place outside the marijuana regulatory system. Recall that New York City cops killed Eric Garner on a Staten Island sidewalk last year in a confrontation predicated on stopping the evasion of one of the highest-in-the-nation cigarette tax rates. Protection of sin tax money streams can be very nasty.

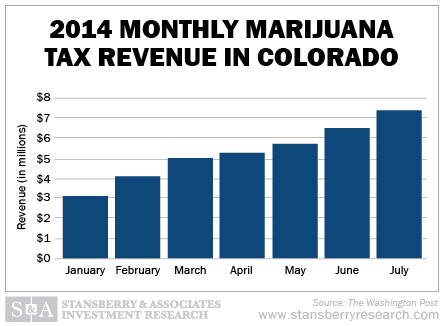

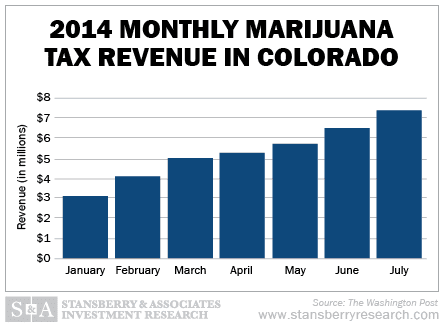

There is indeed much government revenue from marijuana-specific taxes in Colorado. The Marijuana Policy Project places the total for the 12 months ending June 30 at nearly $70 million — 67 percent more than the nearly $42 million in revenue from alcohol-specific taxes during the same period.

How about the government stops taking this money from marijuana purchasers? Let them spend the money on what they choose. Refrain from using the new respect for marijuana freedom as an excuse for imposing oppressive new taxes, manipulating people’s behavior, and funding violations of individual rights.

A one day marijuana tax holiday occurred in Colorado on September 16. The interaction of a state government “accounting error” and state tax law provisions resulted in people in Colorado experiencing that day the freedom of purchasing marijuana free from the compulsion to pay much of the taxes on marijuana. But, freedom is for every day, not just for one day a year. Let’s make every day a holiday from marijuana sin taxes.