Interviewed Tuesday at Bloomberg, Saudi Arabia Finance Minister Mohammed Al-Jadaan indicated that Saudi Arabia would be open to conducting trade, including involving oil, in various currencies — mentioning in particular the euro and the Saudi riyal — instead of the United States dollar. This is the latest in a series of developments suggesting the Middle East nation and large oil producer is shifting away from supporting US dollar hegemony through trade.

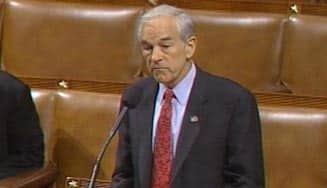

In February of 2006, then US House of Representatives member Ron Paul (R-TX) discussed the history of US dollar hegemony and its looming doom in a House floor speech titled “The End of Dollar Hegemony.” Paul began his speech with his assessment that the dollar dominance, called dollar hegemony more recently and dollar diplomacy in earlier decades of the prior hundred years, “is coming to an end.”

The full history and analysis Paul related in the speech is fascinating. But, there is a particular portion of Paul’s speech that relates to the Saudi finance minister’s comment. This is when Paul focused on the key role the trade of oil has played in supporting dollar hegemony and the related position of the US dollar as the world reserve currency.

Paul explained that after President Richard Nixon removed the final link between gold and the US dollar in 1971, backing of the dollar with oil became key to maintaining dollar dominance. Paul stated:

It all ended on August 15, 1971, when Nixon closed the gold window and refused to pay out any of our remaining 280 million ounces of gold. In essence, we declared our insolvency and everyone recognized some other monetary system had to be devised in order to bring stability to the markets.

Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it — not even a pretense of gold convertibility, none whatsoever! Though the new policy was even more deeply flawed, it nevertheless opened the door for dollar hegemony to spread.

Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence “backed” the dollar with oil. In return, the U.S. promised to protect the various oil-rich kingdoms in the Persian Gulf against threat of invasion or domestic coup. This arrangement helped ignite the radical Islamic movement among those who resented our influence in the region. The arrangement gave the dollar artificial strength, with tremendous financial benefits for the United States. It allowed us to export our monetary inflation by buying oil and other goods at a great discount as dollar influence flourished.

This post-Bretton Woods system was much more fragile than the system that existed between 1945 and 1971. Though the dollar/oil arrangement was helpful, it was not nearly as stable as the pseudo—gold standard under Bretton Woods. It certainly was less stable than the gold standard of the late 19th century.

Come the 1980s, Paul proceeded to state in the speech, additional support was provided to help maintain dollar dominance. Nonetheless, the “petrodollar” system remained a critical support for dollar dominance. Indeed, Paul commented: “If oil markets replace dollars with Euros, it would in time curtail our ability to continue to print, without restraint, the world’s reserve currency.”

That removal of the dollar’s dominant role in oil markets is just what the Saudi finance minister is suggesting.

And the dollar has already been pushed aside significantly in the oil trade over the last year in reaction to US and several other nations’ sanctions on Russia, including on the large Russian oil and gas industry.

Paul, in his speech, describes the US as having been willing to pursue a series of foreign interventions in its decades-long effort to maintain the petrodollar system. It leads one to wonder what is in store as the petrodollar system’s crumbling seems to have much accelerated.

Turbulence is ahead. But, ultimately, Paul proposed in his speech, the end of dollar hegemony could make way for what he describes as a better system. Paul concluded his speech by stating:

Using force to compel people to accept money without real value can only work in the short run. It ultimately leads to economic dislocation, both domestic and international, and always ends with a price to be paid.

The economic law that honest exchange demands only things of real value as currency cannot be repealed. The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or Euros. The sooner the better.