Billionaire hedge fund manager George Soros has proposed a $1 billion contribution of a combined $50 billion investment package in the Ukraine in order to form an economic barrier to Russia’s entry to the war torn nation. In an interview with an Austrian newspaper, Soros said, “The West can help Ukraine by increasing attractiveness for investors.” The Hungarian-born economic hitman may be more interested in helping his, and other investors’, pockets, rather than the people of Ukraine. The speculation here could undermine any truly democratic action in Ukraine. By using low EU Central Bank interest rates to achieve his investments, Soros’s plans begin to bear marked similarities to speculations that destroyed the British Pound and took severe tolls in places like Argentina.

The business model is nothing new for Soros, who has engaged in similar investment projects in West Africa. He continues, “There are concrete investment ideas, for example in agriculture and infrastructure projects. I would put in $1 billion. This must generate a profit. My foundation would benefit from this … Private engagement needs strong political leadership.”

In Nigeria, Cameroon, Uganda and elsewhere, Soros has leveraged his political connections to protect his business interests in those nations. Revenue Watch International, a Soros firm, assisted Uganda in the development of its fossil fuel drilling regulations. Open Society Institute, another Soros non-governmental organization, has recently been responsible for setting up and later overthrowing presidents of Senegal and Congo. Soros maintains significant oil, gold, and diamond drilling operations in these nations. The International Crisis Group, yet another Soros NGO, has repeatedly advised the US Government to provide American military intervention in these fragile societies heavy in natural resources.

The profits would certainly roll in for the relentless investor. Soros Fund Management, LLC maintains ownership of large share percentages in key corporations that will benefit from investment in Ukraine. Soros owns over five million shares of the chemical giant Dow Chemicals, with diversified products and services from industrial to agricultural applications. Another big agricultural winner would be Monsanto. Soros owns half a million shares of the bio-tech firm, which has been a part of most Ukraine political discussions since the civil conflict broke out two years ago. Ukraine has vast supplies of oil and natural gas. Energen, a natural gas utility, could be a prime developer of Ukraine’s fossil fuel reserves. Soros owns nearly two million shares of that company. PDC Energy, with one million shares owned, might be another contender for drilling profits. Soros also owns significant stakes in Citigroup, which stands to be a primary financial intermediary for any investment in Ukraine.

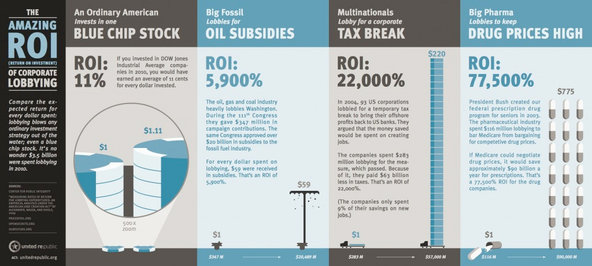

Soros’s investment strategy is not restricted to diversified holdings of major national and international corporations or mutual funds. A significant tactic is the investment in supportive elements within the US government. In 2014, Soros ranked 11th on OpenSecrets.org list of “Top Individual Contributors.” His nearly $4 million open investment (contributions sourced directly to him and not channeled through 501c4 “dark money” organizations) could potentially amount to $400 Million dollars in returns, if not more. The Carmen Group, for instance, a lobbying company in Washington, has claimed that for every dollar invested in lobbying, their clients receive $100 in return. RepresentUs, a campaign finance reform advocacy group, has measured similar extensive gains for political contributions and lobbying expenditures.

Lobbying pays off…

If Soros senses a $100 billion profit, diversified through a number of companies he holds stakes in, he will not mind selling other countries, individual investors, or the IMF to provide the remainder of the $50 billion total investment he thinks Ukraine needs. In fact, this was probably a major conversation topic this year at the Davos World Economic Forum meeting. The majority of these banks and corporations, however, will mine the profits from Ukraine, exporting them to other Western nations. Meanwhile, these corporations will burden Ukraine with significant loans, even if the rates are near zero. Even though these practices have devastated countries like Greece and Argentina, as long as the profits keep rolling in, the investments will continue.

Reprinted with permission from Fifth Column.