Gold at $4,546 an ounce. Silver printing $79+, with a peak around $80 in the last ten days. That isn’t a metals rally blip. It’s the sound of the market dragging a metal detector across the foundation of the post-WWII order and hearing a hollow thud.

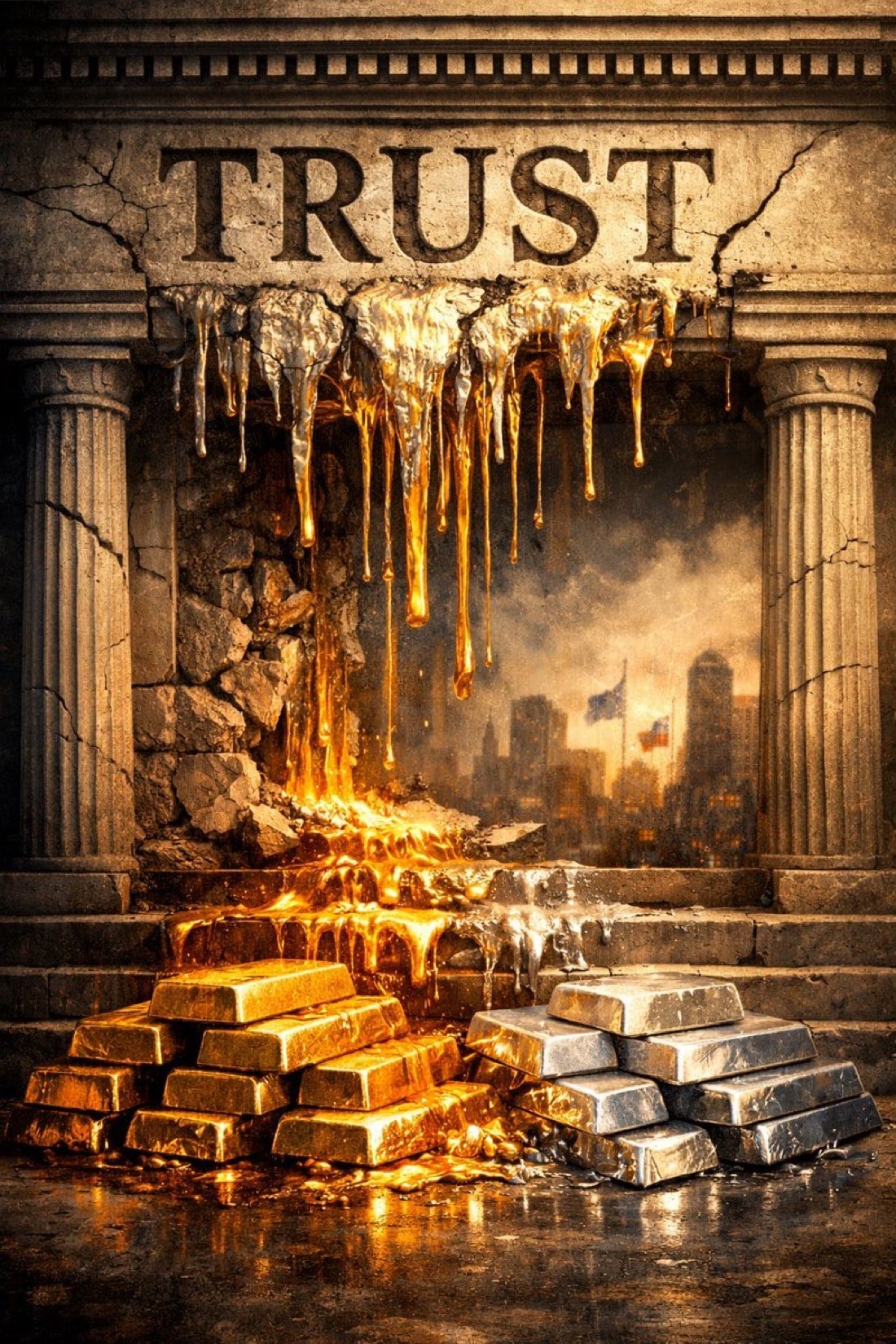

Because this is not really about inflation hedges or safe havens in the tidy textbook sense. This is about trust, the rarest commodity on Earth, and how quickly the illusion evaporates once governments treat finance as a battlefield and law as an instrument of alignment rather than a neutral rulebook.

And here’s the part polite finance avoids saying out loud: the “price” is mostly discovered in paper, futures, forwards, and ETFs, where claims can multiply faster than deliverable metal. That paper depth can dampen signals… until it can’t. Which is exactly why the real tell isn’t the headline quote, it’s who is quietly converting the system’s promises into something the system cannot cancel. China’s reported official gold is now about 2,305 tonnes, Russia’s about 2,329.6 tonnes, India’s about 880, Poland’s about 515, and the direction of travel matters more than the month-to-month noise.

It also matters where that paper price is made. The global gold and silver benchmark is still discovered inside a Western financial architecture, dollar-settled futures in New York, opaque OTC clearing in London, and ETF structures governed by Anglo-American law. That system excels at liquidity and leverage, but it was never built to answer the question sanctions have made unavoidable: who actually controls the metal when politics intrudes? In a world where access can be frozen and rules rewritten, financial claims become conditional. Physical possession does not. That is why the quiet accumulation by states outside the sanctioning core matters more than daily price prints, because ownership, not paper claims, is what ultimately survives regime shifts.

That distinction between paper abundance and physical control is no longer theoretical, it is now being enforced by states. What makes silver especially revealing is that its physical supply is now being explicitly gated by state power and timed with intent. On December 27, Beijing announced that all silver exports will require government licences starting January 1, 2026, a move rooted not in price management but strategic foresight. Silver is indispensable to energy systems, electronics, defense, and industrial processes the modern West cannot function without, yet Western policy remains trapped in quarterly paper cycles and financial abstractions. China is thinking in supply chains and leverage while the West remains fixated on paper liquidity and sanctions theater. By tightening physical outflows as prices surge, Beijing exposes the core illusion of the fiat era, that paper abundance can be printed, but necessity (physical supply) cannot and states that secure the real economy’s inputs will shape the order that follows.

For decades, the dollar-euro system sold the world a simple promise: you can disagree with us politically and still settle, still bank, still hold reserves, still sleep. That promise wasn’t altruism. It was the operating system of post-WWII globalization, the hidden bargain that made Western paper liquid across the planet.

And then came the precedent that will outlive a thousand speeches: the immobilization of Russian sovereign assets parked in Europe, with Belgium and Euroclear as the nerve center of the saga. The EU froze those assets indefinitely, explicitly smoothing the path for financing structures to prop up the corpse of project Ukraine, that lean on the immobilized pool as collateral.

Call it “legal.” Call it “moral.” Call it “necessary.” Markets don’t care what you call it. Markets care what it means. Arbitrary theft, that custody is neither neutral nor safe.

It means that the guardians of the “rules-based order” have announced, with a straight face, that the rules are conditional. That reserve assets are not reserves so much as hostages awaiting the correct politics. That property rights can be suspended by committee, extended by decree, and retrofitted into a funding stream when budgets get ugly.

That is why gold is doing what it’s doing. Gold is not anti-dollar in a meme sense. It’s anti-permission. It’s the asset you buy when you suspect the system is quietly transforming from a marketplace into an enforcement mechanism and the ponzi of Fiat, the illusion of trust is completely shattered. The only value the euro and dollar held was the illusion of trust.

And silver? Silver is the stress fracture made visible. Silver moves like a riot when confidence wobbles, because it’s smaller, tighter, and prone to stampedes. When silver is leaping toward $80, it’s not telling you “a new iPhone needs more circuitry.” It’s telling you that the crowd is running toward assets that cannot be frozen, gated, or conditionally honored.

Zoom out. The geopolitical picture is hardening, not calming. Sanctions have become permanent architecture rather than a temporary lever, increasingly detached from international law and the UN Security Council framework that once conferred legitimacy. The “freeze” becomes an “indefinite freeze.” The “indefinite freeze” is then rebranded as financing, but without consent, maturity, or return, it is not a loan. It is confiscation (theft) by bureaucratic process. And each step broadcasts the same message to the Global South, the non-aligned, and even nervous allies, that your savings are subject to our politics.

This is where the euro and dollar take the real hit, not as an overnight collapse, but as an erosion of the one thing a reserve currency cannot counterfeit, neutrality.

Reserve managers do not need to love Russia to learn from Russia. They only need to understand incentives. If a major state’s central bank assets can be immobilized in Europe and then placed into “structures” designed to fund a war, every other state asks the obvious question in a whisper… What happens when we’re the next disagreement?

The answer to that question is why dedollarization never needed a conference, it needed a precedent. The precedent is now in plain sight. And yes, a handful of European states (Belgium, Hungary, Slovakia, Malta and Italy) can object at the margins, slow the machinery, demand more paperwork. But the signal is already broadcast, that the West is willing to treat the reserve system as an extension of coercive policy.

That’s a civilizational mistake. Because the post-WWII order was not underpinned by liberal virtue, it was underpinned by the perception of predictability. Once predictability dies, you don’t get it back with another summit communique. You get it back by changing behavior for a generation. Until then, you get the metal bid.

So when you see gold at $4,600 and silver over $8l, read it as a referendum: the market is voting against the idea that the current financial “order” is stable, apolitical, or trustworthy.

And here’s the punchline…

The West is discovering that you can seize trust once, but you pay for it “indefinitely”.