When the IRS announced two weeks ago that it would not enforce a section of federal law commonly called the Johnson Amendment, many clerics rejoiced. The Johnson Amendment — named for its author, then-Sen. Lyndon B. Johnson — strikes a bargain with charities. You accept tax-free dollars, you stay out of the political arena.

The amendment is the federal law, codified in the IRS Code at 501(c)(3), that permits the IRS to grant tax-exempt status to qualifying charities. The tax exemptions generally permit the charity to solicit and accept financial contributions using pre-tax dollars, and relieves them from paying taxes on the income collected thereby. In return, the charity agrees to refrain from engaging in or financing partisan politics.

Most colleges and universities have this status, and nearly all religious institutions do. In many cases, local and state governments will grant their own tax exemptions, which generally exempt charities from paying real estate taxes on their properties and from collecting sales taxes on any goods that they sell.

Protestant ministers have often bemoaned the Amendment because they have longed for the ability to endorse candidates for public office publicly. Catholic priests have sought this as well, though the more traditional ones understand that recommending a political candidate from the pulpit has negative implications in canon law. Indeed, the United States Conference of Catholic Bishops — the governing body for American priests — recently indicated that it will adhere to the traditional understanding of the amendment, which means no public political endorsements.

What became of the Johnson Amendment? Since it is a federal statute, can the IRS abrogate it? Can the president pick and choose which laws to enforce and which parts of the laws to go unenforced?

Here is the backstory.

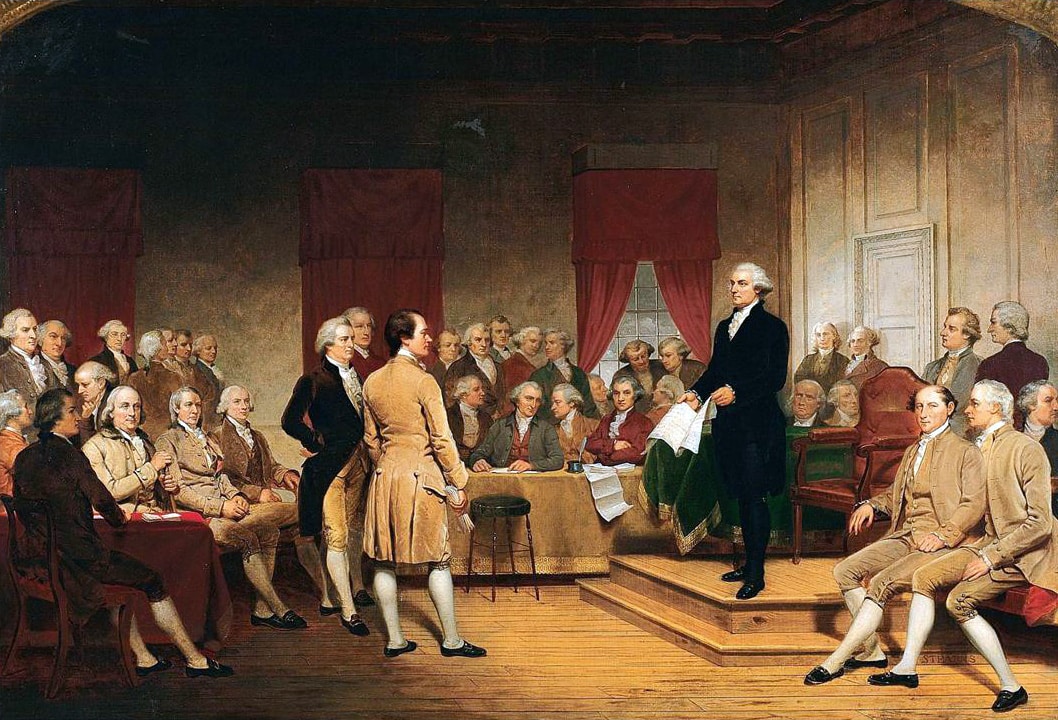

When James Madison was the scrivener at the Constitutional Convention in Philadelphia in 1787, he crafted the idea of the separation of powers. The separation mandates that only Congress can write the laws, only the president and those whom he hires to work for him can enforce the laws, and only the judiciary can decide what the laws mean and if they conform to the Constitution.

The flip side of the separation of powers is twofold. First, the separation prohibits any of the three branches from performing the core duties of either of the other two, whether by stealth, force or even permission. Core duties are those articulated in the Constitution or unambiguously derived from it. Thus, only Congress can impose taxes, as that core duty is assigned to it by the Constitution. This is essentially the reason that President Donald Trump’s tariffs have been found unconstitutional; a tariff is a tax, and only Congress can impose taxes.

The second flip side of the separation is the presumption that each branch will in fact do what the Constitution charges it with doing: Congress will write the laws, and the president will enforce them as they are written, and the courts will interpret them.

What happens if the president chooses to enforce laws only against certain persons but not against others arguably covered by the law?

That’s what happened with the partial abrogation of the Johnson Amendment by the IRS. The IRS works for the Secretary of the Treasury, who in turn works for the president. They are all part of the executive branch machinery charged with enforcing federal laws.

Now, back to Madison in Philadelphia. He had a healthy skepticism and fear of executive power. He and his generation had lived during the most oppressive colonial times in which British soldiers and government agents enforced the will of King George III upon them. And, of course, he and his generation had waged a bloody war against the king, as a result of which the 13 colonies seceded from Britain.

Madison feared presidents being disingenuous and effectively doing whatever they wanted to do with federal laws. He knew that presidents would be tempted to pick and choose which laws to enforce and which to disregard. He warned against the selective enforcement of federal statutes, the effect of which is to nullify federal laws for certain persons.

In order to prevent this, he insisted that the presidential oath of office be included in the Constitution and that all presidents swear in the oath to enforce the laws FAITHFULLY. No such requirement of faithfulness is textually imposed upon the Congress or the courts.

Madison also sought to prevent the selective enforcement of laws via the Fifth Amendment’s imposition of equal protection of the laws upon the federal government.

Nevertheless, presidents since Thomas Jefferson — even Madison himself — have succumbed to the temptation of choosing which laws to enforce and which to ignore.

Two weeks ago, Trump’s IRS publicly announced the upcoming selective enforcement of the Johnson Amendment. Selective enforcement is profoundly unconstitutional, as it dilutes the legislation Congress has enacted, permits the president subjectively to reward friends and burden enemies, and defies the presidential oath to enforce laws faithfully.

Now the president can decide against whom to enforce the amendment by the public political speech of the 501(c)(3) charities. This, in turn, involves the government evaluating the content of speech — and that is prohibited by the First Amendment.

What’s going on here?

We are witnessing an erosion of democracy when the executive branch can be unfaithful about enforcing laws. Yet, if we take a step back from the Johnson Amendment, we see what happens when the government presumes it has a prior claim on our income greater than we do and then conditions its claims in order to induce the behavior it wishes.

Stated differently, Jefferson argued that the only moral commercial transactions are those which are bilaterally voluntary — by which he meant that income taxation is theft. You want a service from the government, you pay for it. Otherwise leave our income alone. But taxation with conditions of behavior attached is worse than theft. It is tyranny.

To learn more about Judge Andrew Napolitano, visit https://JudgeNap.com.

COPYRIGHT 2025 ANDREW P. NAPOLITANO

DISTRIBUTED BY CREATORS.COM